maine property tax rates by town 2021

The typical Maine resident will pay 2597 a year in property taxes. State Treasurer Henry Beck has announced that the delinquency property tax rate can only top out at 6 percent for 2021 and he is also not applying an additional 3 percent penalty.

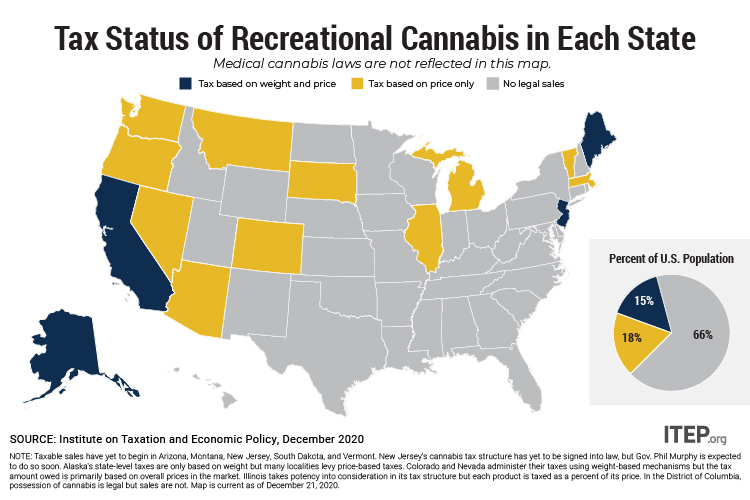

New Jersey Leads By Example With Its New Cannabis Tax Itep

The 2021 taxes are due by September 17 2020.

. Ad Property Taxes Info. The US Census Bureau The Tax Foundation and Tax-Rates. We value your comments and suggestions.

This process is administered by Maine Revenue Services. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. 2018 Tax Acquired Bid Packet PDF Winning Bids for the Current Tax Acquired Properties Excel.

Tax Payment Information and Bills. Town of Eliot 1333 State Road Eliot Maine 03903 207 439. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes.

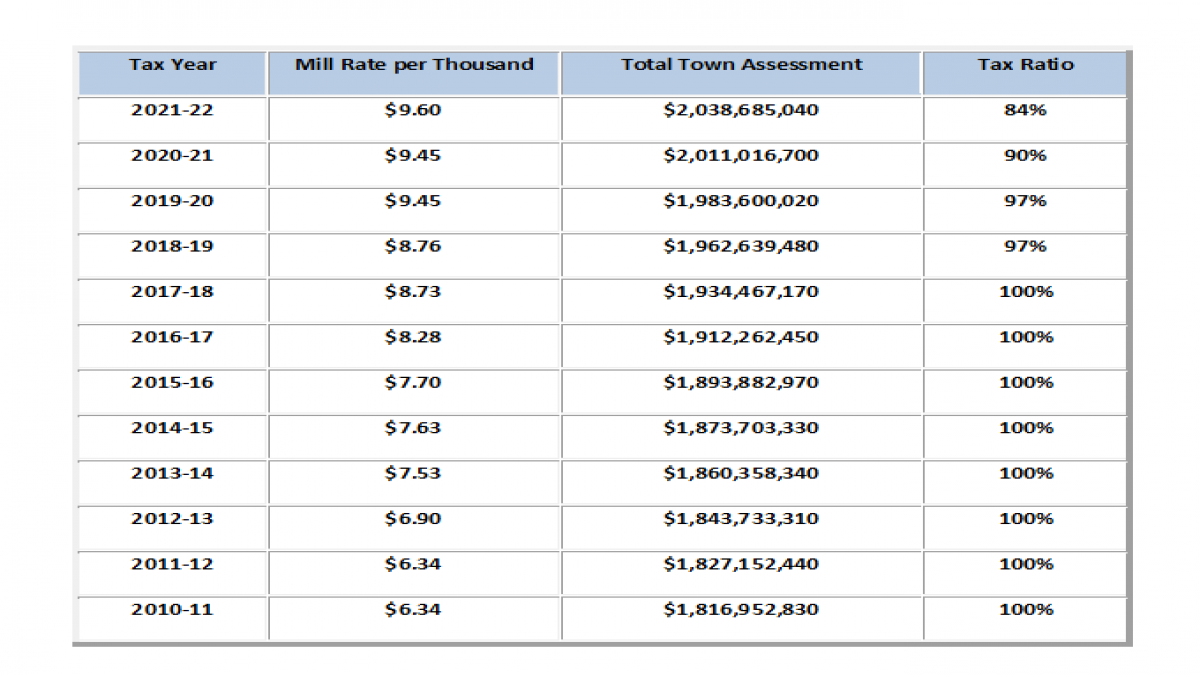

The statewide median rate is 1430 for every 1000 of assessed value. City of Old Town. 2021-2022 Tax Bills2020-2021 Tax Bills2019-2020 Tax Bills2018-2019 Tax Bills2017-2018 Tax Bills2016-2017 Tax Bills2015-2016 Tax Bills2014-2015 Tax Bills2013-2014 Tax.

13 rows Maine Tax Portal. The Median Maine property tax is 193600 with exact property tax rates varying by location and county. After said date the principal balance will accrue interest at a rate of 6 annually as determined by the State.

Tax bills are sent out annually around the first week in August and installments are due September 10th and March 10th. Maine 109 19 Minnesota 105 20 Massachusetts 104 21 Alaska 104 22 Florida 097 23 Washington 092. 27 rows A complete listing of property tax rates for Cumberland County Maine including.

Below are links to the 2021 valuation books and maplot indexes. Real Estate Tax Bills Download a copy of your tax bill by clicking the link. Fireworks pictures by Courtney Burns.

Real Estate. The following is a list of. Or to compare property tax rates across Maine see the Penobscot County property tax page.

Start filing your tax return now. 2021 Tax commitment information. 2019 - 1185 per 1000 valuation.

Annually the unorganized territory has tax acquired parcels that are sold via a sealed bid process. 2021 Tax Rate On August 17 2021 the Town Council set the property tax rate for the 2021-22 tax year at 1260 mils 389 Municipal 814 School 057 County with a certified assessment ratio of 100. Pay property taxes online.

This page provides information of interest to municipal assessors and other property tax officials in Maine. The Property Tax Division is divided into two units. If there is something missing that you think should be added to this page feel free to email us with the link or suggestion.

Property tax rates in Maine are well above the US. Taxes are payable at the Town Hall 6 Elm. 2020 - 1190 per 1000 valuation.

Municipal Services and the Unorganized Territory. 1 Median property tax rates displayed as a percentage of property value. The State Valuation process which takes about 18 months to complete begins with the compilation of a sales ratio study which measures.

Each year prior to February 1st Maine Revenue Services must certify to the Secretary of State the full equalized value of all real and personal property which is subject to taxation under the laws of Maine. How can we improve this page. Thank you to all of our citizens who voted in the November 2 2021 State Referendum Election either by Absentee Ballot or in person at our polls.

Please contact the Tax Collector if you would like to receive your tax bills electronically. The states average effective property tax rate is 130 while the national average is currently around 107. For questions or concerns regarding this or previous years.

Payments on your account can be made at any time in person by mail or online. Searching Up-To-Date Property Records By County Just Got Easier. The state valuation is a basis for the allocation of money.

Windham has 9023 Real Estate accounts and 1162 Personal Property accounts with a combined taxable value of 2734905000. Property Tax Fairness Credit. Overview of Maine Taxes.

Publications and Exemption Applications. Start filing your tax return now. Rockland 2022 Tax Bills Rockland 2021 Tax Bills Rockland 2020 Tax Bills Rockland 2019 Tax All Current Alerts Announcements There are no current alerts or announcements.

At the median rate the tax bill on a property assessed at 100000 would be 1430. Please refer to your tax bill for additional information. Welcome to Maine FastFile.

Property Tax Maps and Information. Property Tax bills are assessed on a yearly fisal year basis of July 1st through June 30th. 2021 - 974 per 1000 valuation.

Washington Village Park original plans. Copies of these bills are available below. 2018 - 1156 per 1000 valuation.

This Jersey Shore town of nearly 92000 people has the fifth-lowest estimated senior tax burden of 1518. 2017 - 1096 per 1000 valuation.

Tax Maps And Valuation Listings Maine Revenue Services

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Maine Property Tax Calculator Smartasset

Maine Property Tax Rates By Town The Master List

Maine Property Tax Rates By Town The Master List

Maine Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Newmarket Tax Rate Set At 25 46

Looking For Property Tax Bargains In N J These 30 Towns Have The Lowest Tax Rates Nj Com

Tax Rates Town Of Kennebunkport Me

Maine Property Tax Rates By Town The Master List

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Maine Property Tax Rates By Town The Master List

The Most And Least Tax Friendly Us States

How Is Tax Liability Calculated Common Tax Questions Answered

Property Tax Information Town Of Bowdoin Maine

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future